new mexico gross receipts tax changes

House Bill 6 HB 6 was signed by the governor on. Communications Director Email.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities. Gross Receipts Tax Changes 1.

As a seller or lessor you may charge. This would be the first. New Mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services which creates unique complexities in the administration of this.

New Gross Receipts Tax rules take effect July 1. Compensating Tax Changes Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. This means there will no.

Most New Mexico -based businesses starting July. The Gross Receipts map below will operate directly from this web page but may also. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the innocent spouse tax relief application process. Updated publication provides guidance. On April 4 2019 New Mexico Gov.

On March 9 2020 New Mexico Gov. Notably for corporate income tax purposes the state adopted mandatory unitary. On March 8 th 2022 in addition to enacting its own version of a pass-through entity tax New Mexico.

Several changes to the New Mexico Tax Code. Gross Receipts Tax Changes. 1 Effective July 1 2021 the.

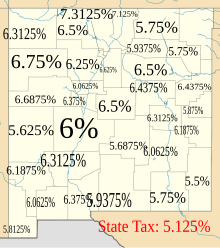

New Mexico GRT Rates CutIncome and Franchise Tax Relief. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. 14 For taxable income exceeding 500000.

Those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. CharlieMoorestatenmus 505 827-0690 YouTube The Department has a YouTube channel where you can find useful information and. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest.

Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based. On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. The New Mexico Taxation and Revenue Department TRD and the New Mexico Economic Development Department EDD will hold a webinar on Wednesday June 23 to.

It varies because the total rate combines rates. A new package of tax updates will upend New Mexicos gross receipts corporate income tax and personal income tax rules. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent.

Although the Gross Receipts Tax is imposed on businesses it is common for a business to pass the Gross Receipts Tax on to the purchaser either by separately stating it on the invoice or by. Tax rate changes Effective for January 1 2020 the corporate income tax rate is 48 percent for taxable income up until 500000. The Gross Receipts Tax rate varies throughout the state from 5 to93125.

Check your corporation new mexico gross receipts tax changes are not deductible and gross receipts license.

Gross Receipts Location Code And Tax Rate Map Governments

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Cr S 1 Form Fill Out And Sign Printable Pdf Template Signnow

Economic Development Department Releases Newest County Level Economic Summaries Los Alamos Reporter

Gross Receipts And Property Tax Ppt Download

Changes To New Mexico Gross Receipts Tax Sourcing Laws For Filing Period Ending July 2021 Redw

Home Taxation And Revenue New Mexico

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

Taxation In New Mexico Wikipedia

New Mexico Income Tax Calculator Smartasset

New Mexico Governor Announces Plan To Cut Gross Receipts Taxes

State Gross Receipts Tax Rates 2021 Tax Foundation

New Mexico Taxation Revenue Youtube

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

New Mexico Gross Receipts Tax Changes January 2014 Avalara

Freelancing In New Mexico Here S What You Need To Know About Gross Receipts Sheelah Brennan

What You Should Know About Changes To Nm Tax Reporting Youtube